Exclusive Family

Enjoy financial elegance in every detail with a range of complex services, exclusive products and unique benefits designed especially for you and your entire family.

MDL / USD / EUR

0 MDL*

FREE OF CHARGE

3

FREE OF CHARGE

FREE OF CHARGE

Personal Manager – your financial assistant will provide financial support by individual approach.

Priority service – save time when performing necessary banking transactions.

Travel insurance – global cover up to EUR 704 000.

Credit line – 30% discount from the standard rate.

Loans – additional discount.

Deposits – more favourable interest rate.

Banking services – exclusive and advantageous offers on certain banking services.

Relaxing trips for the whole family.

Discount program – up to -10% from Moldindconbank partners.

Lounge Key – unlimited number of entries subject to conditions, to relax before the flight. The World Elite cardholder has the possibility to take into the area + 5 companions.

Concierge – personal assistance service, 24/7 support, Mastercard.

Car rental program – discounts on car rental abroad.

Possibility to get discounts when booking hotels through booking.com

SMS Notifications service.

Receiving the bank statement via e-mail.

Information in MICB Mobile Banking.

Push notification from MICB Mobile Banking.

Bank mini-statement on ATM screen.

The deposits of individuals and legal entities are guaranteed up to the coverage level of MDL 200,000.

More details: FGDSB brochure

Tariff Plan

Tariff Plan

Exclusive Family Package

Account maintenance

MDL 0/MDL 500Card maintenance

FREE OF CHARGECard issuance

FREE OF CHARGECard package

3SMS Notifications service – Unlimited

FREE OF CHARGEViewing the balance and bank mini-statement on the Bank’s ATM screen

FREE OF CHARGERequired documents

Discount of up to 10% with Discount Club

If you are a holder of the Card exclusively for women from the Republic of Moldova PudraCard, you also benefit from additional discounts of up to 10%.

Find your favorite store in the Discount Club list.

e-Wallets

- Pay securely, quickly and easily with electronic devices! Add card to e-wallets.

- Moldindconbank customers are among the first to enjoy this experience!

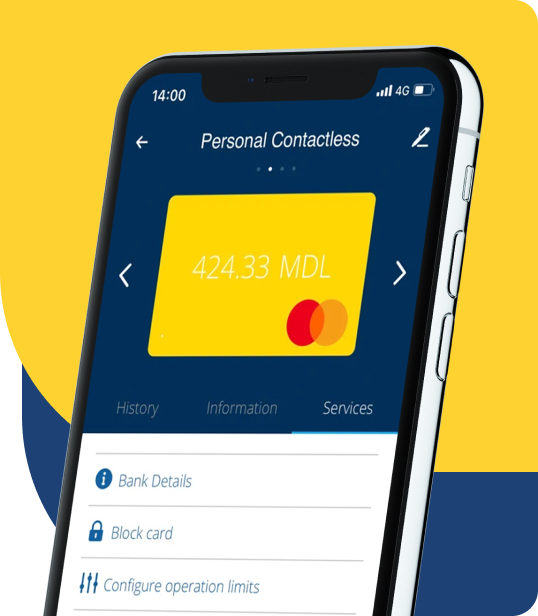

Mobile Banking

-

Access quickly and securely with remote service.

-

Pay bills comfortably and for free.

-

Make P2P transfers – between payment cards anywhere in the world.

-

Make P2C transfers – to current accounts of beneficiaries from the Republic of Moldova.

-

Plan and pay off loans without concerns.

-

Manage expenses, through graphical visualization and analysis.

-

Save time by accessing and managing accounts online.

ATM services

-

Changing the PIN code – free of charge.

-

Cash IN – card account replenishment – free of charge.

-

Cash Out – cash withdrawal – free of charge.

Credit line on card

-

Open a Credit Line – turn your card into a credit card!

-

Harmoniously combine the benefits of debit and credit cards. Enjoy shopping without interest – during the fixed grace period of 60 days.

-

Pay interest ONLY on the amount used.

Concierge service

Your personal assistant, available 24/24 (tel.: +373 78 903 814), to solve any problem and help you in emergency situations.

Organization of individual trips, recruitment of domestic staff, selection and ordering of products and services, etc.

Regular event planning services, planned according to the schedule.

Personal reminders (about important life events – birthdays, doctor’s appointments, etc.).

Hotel search services, purchase/booking of air tickets, to the theatre, restaurant, event organization, etc.

Assistance in organizing and planning your vacation, for visas, transportation, accommodation, entertainment, etc.

The possibility of connecting an additional person to the MasterCard Concierge program for free.

Membership of Premium private (golf, yacht, etc.) clubs worldwide.

24/24 Access.

Available in Russian and English – phone conversations, SMS, Telegram BOT.

Lounge Key

The wait has never been more pleasant. Now you can really relax before your flight in airport lounges around the world.

Warm welcome upon every visit regardless of airline and class of service (ticket category).

Instant access to the waiting room upon submission of the card.

Free snacks and comfortable furniture.

Over 1,100 business lounges available in almost every airport in the world.

Download the LoungeKey application to find lounges faster and access special, secure content available to registered users only. You can download the application from the Apple App Store and Google Play.

Lounge Key access for Moldindconbank customers: loungekey.com/moldindconbank.

Mastercard business lounge

Free access to Mastercard business lounges in the airports of the cities: Chisinau, Bucharest (Henri Coanda), Vienna (Schwecha), Budapest (Ferenc Liszt), Prague (Vaclav Havel t1), Kiev (Boryspil tD), Moscow (Sheremetyevo tE), Tbilisi (Shota Rustaveli), Batumi, Saint Petersburg (Pulkovo Airport).

Free food and drinks.

FAQ:

You can top up the card easily and quickly at any CASH-IN ATM of the bank or at the counter. At the same time, the account can be replenished by receiving transfers from Moldova and abroad or through P2P.

You can request additional cards with access and transaction limits for your family members and other users.

It is recommended to choose the currency of the account according to the currency of your income.

When paying by card in countries where the national currency is not EUR or USD, the following conversions are performed:

- from the account currency => into MDL;

- from MDL => into USD;

- from USD=> into the national currency.

Therefore, if the card is to be used for operations abroad in both EUR and in other currencies, it is recommended to open the specific account in MDL to avoid double conversion of currencies.

If the card is to be used to receive transfers from abroad, it is recommended to choose the currency of the account depending on the currency of the transfers.

Conversion for payment cards takes place as follows: the currency, in which the payment card transaction takes place, is compared to the settlement currency, which, in turn, is compared to the currency of the card account. If the transaction currency does not match the settlement currency and/or the settlement currency does not match the card account currency, then the conversion takes place.

When the transaction currency is compared to the settlement currency (EUR or USD) and does not match, then the conversion takes place at the rate of the payment system. Then, if the currency of the settlement does not match the currency of the card account, then the conversion takes place at the commercial rate of the Bank, for operations with payment cards. This exchange rate is established every day, at the close of the operational day: on weekdays, at around 19:00 – 20:00; on non-working days and at the end of the month, at around 17:00 – 18:00. The exchange rate is published on the website of the Bank. The commercial rate may differ from the official rate of the NBM, the rates of the payment systems and/or the commercial rates of the Bank, for cash operations in foreign currency.

Conversion scheme, where:

• GBP transaction currency – any currency other than MDL, USD, EUR.

• Visa rate

• Mastercard rate

• MICB rate

Additional information can be obtained from the Card Support Service, at the phone number: (+373) 22 71 71 71, or on the website.

The card is provided with the contactless technology and allows you to quickly pay for purchases, in the country and abroad, by simply bringing the card close to the POS payment terminal. There is no need to enter your PIN or sign the check for purchases of less than MDL 1,000. Purchases larger than MDL 1,000 will be confirmed by entering PIN (the amount limit for contactless transactions without a PIN differs from one country to another).