Start Family

Provides comfort and unique benefits tailored to your needs, discounts and additional privileges!

MDL / USD / EUR

0 MDL*

80 MDL

2

FREE OF CHARGE

FREE OF CHARGE

Lounge Key – unlimited number of entries subject to conditions.

Concierge – personal assistance service, 24/7 support, Mastercard or Visa.

Car rental program – car rental discounts and free additional services from partners:

- Mastercard Hertz; Avisworld; Rentalcars.

- Visa Avisworld; Rentalcars.

Discount program – for Moldindconbank partners.

Cashback up to 6% on accommodation bookings via booking.com with Visa Platinum card.

SMS-Notifications service.

Receiving the bank statement via e-mail.

Information in MICB Mobile Banking.

Push-notification from MICB Mobile Banking.

Bank mini-statement on ATM screen.

The deposits of individuals and legal entities are guaranteed up to the coverage level of MDL 200,000.

More details: https://fgdsb.md/

Tariff Plan

Tariff Plan

Start Family package

Account maintenance

0 MDL / 150 MDLCard maintenance

FREE OF CHARGECard issuance

80 MDLCard package

2SMS-Notifications service – 15 messages

FREE OF CHARGESMS-Notifications service – 25 messages

MDL 15SMS-Notifications service – Unlimited

MDL 25Viewing the balance and bank mini-statement on the Bank’s ATM screen

3 – free of charge, MDL 1Viewing the balance and bank mini-statement on ATM screen of other banks (if technically possible)

EUR 1Required documents

Discount of up to 10% with Discount Club

If you are a holder of the Card exclusively for women from the Republic of Moldova PudraCard, you also benefit from additional discounts of up to 10%.

Find your favorite store in the Discount Club list.

e-Wallets

- Pay securely, quickly and easily with electronic devices! Add card to e-wallets.

- Moldindconbank customers are among the first to enjoy this experience!

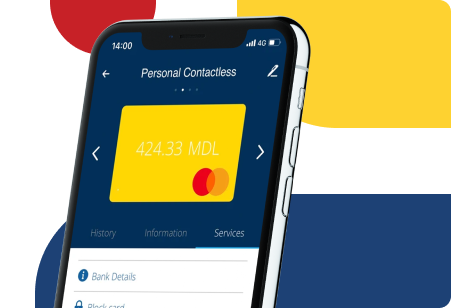

Mobile Banking

-

Access quickly and securely with remote service.

-

Pay bills comfortably and for free.

-

Make P2P transfers – between payment cards anywhere in the world.

-

Make P2C transfers – to current accounts of beneficiaries from the Republic of Moldova.

-

Plan and pay off loans without concerns.

-

Manage expenses, through graphical visualization and analysis.

-

Save time by accessing and managing accounts online.

ATM services

-

Changing the PIN code – free of charge.

-

Cash IN –card account replenishment – free of charge.

-

Cash Out – cash withdrawal – free of charge.

Credit line on card

-

Open a Credit Line – turn your card into a credit card!

-

Harmoniously combine the benefits of debit and credit cards. Enjoy shopping without interest – during the fixed grace period of 60 days.

-

Pay interest ONLY on the amount used.

FAQ:

You can top up the card easily and quickly, at any CASH-IN ATM of the bank or at the counter. At the same time, the account can be replenished by receiving transfers from Moldova and abroad or through P2P.

You can request additional cards with access and transaction limits for your family members and other users.

It is recommended to choose the currency of the account according to the currency of your income.

When paying by card in countries where the national currency is not EUR or USD, the following conversions are performed:

- from the account currency => into MDL;

- from MDL => into USD;

- from USD=> into the national currency.

Therefore, if the card is to be used for operations abroad in both EUR and in other currencies, it is recommended to open the specific account in MDL to avoid double conversion of currencies.

If the card is to be used to receive transfers from abroad, it is recommended to choose the currency of the account depending on the currency of the transfers.

Conversion for payment cards takes place as follows: the currency, in which the payment card transaction takes place, is compared to the settlement currency, which, in turn, is compared to the currency of the card account. If the transaction currency does not match the settlement currency and/or the settlement currency does not match the card account currency, then the conversion takes place.

When the transaction currency is compared to the settlement currency (EUR or USD) and does not match, then the conversion takes place at the rate of the payment system. Then, if the currency of the settlement does not match the currency of the card account, then the conversion takes place at the commercial rate of the Bank, for operations with payment cards. This exchange rate is established every day, at the close of the operational day: on weekdays, at around 19:00 – 20:00; on non-working days and at the end of the month, at around 17:00 – 18:00. The exchange rate is published on the website of the Bank. The commercial rate may differ from the official rate of the NBM, the rates of the payment systems and/or the commercial rates of the Bank, for cash operations in foreign currency.

Conversion scheme, where:

• GBP transaction currency – any currency other than MDL, USD, EUR.

• Visa rate

• Mastercard rate

• MICB rate

Additional information can be obtained from the Card Support Service, at the phone number: (+373) 22 71 71 71, or on the website.

The card is provided with the contactless technology and allows you to quickly pay for purchases, in the country and abroad, by simply bringing the card close to the POS payment terminal. There is no need to enter your PIN or sign the check for purchases of less than MDL 1,000

Purchases larger than MDL 1,000 will be confirmed by entering PIN (the amount limit for contactless transactions without a PIN differs from one country to another).