Sustainability:

What is ESG?

Environmental

Protecting environment and natural systems

Social

Promoting people’s rights, well-being and interests

Governance

Governance structure, ethics and conduct, transparency and reporting

What does the Bank do:

supports sustainable economic growth

contributes to increasing quality of life and social well-being

promotes the circular economy by financing sustainable projects

ensures the health and safety of employees

promotes solidarity, inclusion and sustainability

helps to promote a more responsible and environmentally friendly business environment

ESG principles of the Bank:

✔️ Respect for fundamental human rights;

✔️ Integrity, honesty and mutual respect in relations with partners;

✔️ Legality of actions taken and responsibility for their consequences;

✔️ Design and delivery of sustainable products;

✔️ Promotion of “responsible investment” in the national economy;

✔️ Assessment of ESG risks in the analysis of products, services and projects financed, as well as in decision-making processes;

✔️ Integration of environmental, social and governance criteria in the Bank’s activity.

Integrating ESG principles:

Sustainable lending

Responsible employer

Responsible social actor

Bank’s ESG offerings:

- Financing sustainable projects

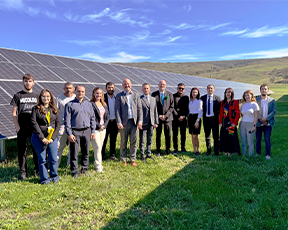

The Bank supports and promotes long-term sustainable investments by setting science and research-based targets to mitigate climate change and develop alternative energy sources and energy efficiency projects. In the area of energy efficiency improvement and green energy development, the Bank promotes the implementation of energy-efficient technologies and development of smart grids, including through:

- exploitation of wind and hydro energy (wind power plants, wind farms, small hydropower plants);

- exploitation of solar energy by converting it into electricity and heat (photovoltaic parks);

- development of the energy potential of biomass, i.e. biofuel production from cereals and technical oil crops;

- exploitation of geothermal energy (shallow geothermal systems and heat pumps).

- Eco Car loan

With the aim of protecting and reducing environmental pollution, the Bank launched in October 2024 the Eco Car loan product, aimed at individuals for the purchase of electric, hybrid and plug-in hybrid cars (eco category), for a 5-year term, with a more favorable interest rate than those not included in the eco category.

Other achievements

During 2024, the Bank renovated the bank’s vehicle fleet by purchasing electrically powered cars and installing electric power stations.

With regard to indirect emissions, the Bank has reduced the number of car and air trips of employees and members of the governing bodies, thus the majority of meetings are organized online. The rationality and frequency of the use of cars for regional and inter-branch trips was also reviewed.

In order to improve internal environmental performance, the Bank has implemented an environmental management system focused on compliance with environmental regulations, pollution prevention and reduction of greenhouse gas emissions. One of the cornerstones of the Bank’s management system is the Exclusion List, which identifies activities that are considered illegal or have a negative impact on the community and the environment. The Bank thus ensures that it will not finance, directly or indirectly through financial intermediaries, projects associated with the activities on this list.

Moldidnconbank promotes sustainability by adopting responsible attitudes towards the environment. In July, the bank joined the Plastic-Free July campaign launched by AO E-Circular, under the slogan “Turn Off the Tap – Stop Plastic Pollution”, which encouraged the use of sustainable practices and the adoption of a more responsible attitude towards the environment.